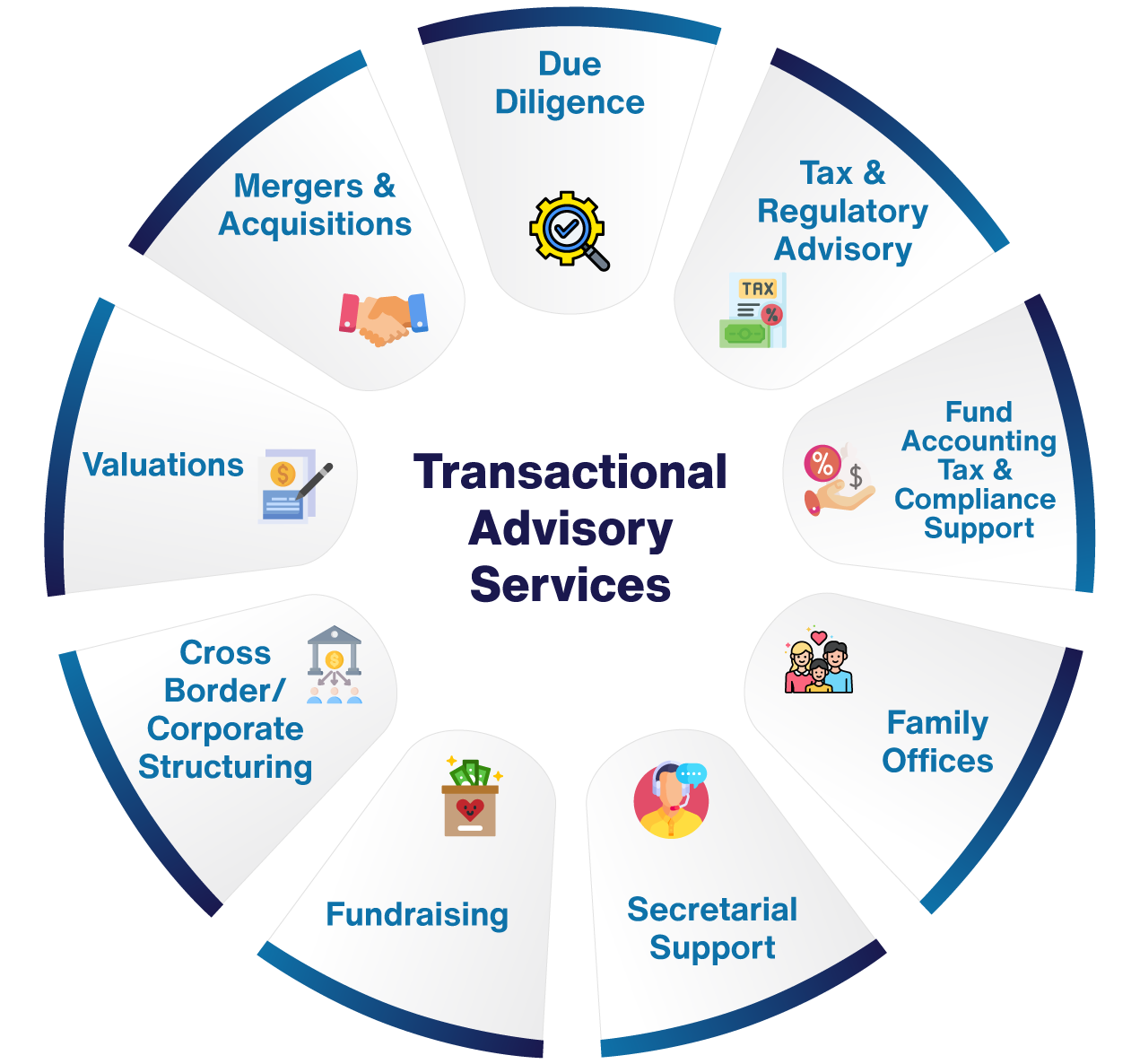

Some Known Details About Transaction Advisory Services

Wiki Article

The Ultimate Guide To Transaction Advisory Services

Table of ContentsFascination About Transaction Advisory ServicesTransaction Advisory Services Things To Know Before You Get ThisThe smart Trick of Transaction Advisory Services That Nobody is DiscussingRumored Buzz on Transaction Advisory ServicesThe Best Guide To Transaction Advisory Services

This action makes certain the business looks its finest to possible customers. Obtaining the organization's worth right is important for a successful sale.Deal experts step in to help by obtaining all the required info organized, addressing inquiries from customers, and preparing visits to the business's place. This constructs count on with customers and keeps the sale moving along. Obtaining the finest terms is key. Transaction advisors use their knowledge to help entrepreneur handle difficult negotiations, satisfy purchaser expectations, and framework bargains that match the proprietor's objectives.

Meeting lawful policies is crucial in any kind of organization sale. They assist organization proprietors in planning for their following steps, whether it's retired life, beginning a brand-new venture, or handling their newfound wealth.

Transaction experts bring a riches of experience and knowledge, making sure that every element of the sale is taken care of professionally. With calculated prep work, assessment, and negotiation, TAS helps local business owner accomplish the greatest possible price. By making sure lawful and regulative conformity and managing due diligence together with various other offer group participants, purchase advisors reduce prospective threats and obligations.

All About Transaction Advisory Services

By contrast, Large 4 TS teams: Job on (e.g., when a potential customer is performing due diligence, or when a deal is shutting and the customer needs to integrate the business and re-value the vendor's Balance Sheet). Are with fees that are not linked to the bargain shutting successfully. Make fees per engagement someplace in the, which is much less than what investment banks earn also on "tiny bargains" (but the collection chance is additionally a lot greater).

The meeting concerns are extremely comparable to financial investment banking interview inquiries, but they'll focus a lot more on bookkeeping and valuation and much less on subjects like LBO modeling. Anticipate concerns regarding what the Adjustment in Working Resources means, EBIT vs. EBITDA vs. Web Earnings, and "accountant just" subjects like trial equilibriums and how to go through events using debits and credit reports rather than monetary statement modifications.

The Best Guide To Transaction Advisory Services

Specialists in the TS/ FDD groups may also interview management concerning whatever over, and they'll write a comprehensive record with their searchings for at the end of the process.The power structure in Transaction Services differs a bit from the ones in investment banking and personal equity careers, and the basic form looks like this: The entry-level function, where you do a great deal of data and More Help economic analysis (2 years for a promotion from here). The following level up; comparable job, yet you get the more intriguing bits (3 years for a promo).

Particularly, it's challenging to get promoted beyond the Supervisor degree since couple of individuals leave the job at that stage, and you need to start revealing proof of your capability to produce income to development. Allow's begin with the hours and way of life because those are much easier to define:. There are periodic late evenings and weekend break job, however nothing like the agitated nature of financial investment financial.

There are cost-of-living modifications, so anticipate reduced settlement if you're in a cheaper place outside significant financial (Transaction Advisory Services). For all positions other than Companion, the base salary consists of the mass of the total settlement; the year-end perk could be a max of 30% of your base income. Typically, the very best way to boost your earnings is to switch to a different firm and work out for a higher income and incentive

Things about Transaction Advisory Services

You can get involved in corporate advancement, however investment financial obtains a lot more challenging at this phase due to the fact that you'll be over-qualified for Analyst roles. Business finance is still a choice. At this stage, you should simply stay and make a run for a Partner-level function. If you intend to leave, maybe move to a customer and execute their evaluations and due persistance in-house.The main problem is that because: You usually require to sign up with one more Huge 4 team, such as audit, and job there for a few years and afterwards move into TS, work there for a couple of years and after that relocate right into IB. And there's still no assurance of winning this IB duty because it depends upon your region, customers, and the hiring market at the time.

Longer-term, there is also some threat of and because reviewing a firm's historic economic information is not exactly rocket scientific research. Yes, people will constantly require to be entailed, yet with i loved this even more advanced technology, lower headcounts might potentially sustain customer engagements. That stated, the Purchase Solutions group beats audit in terms of pay, job, and leave opportunities.

If you liked this write-up, you might be curious about reading.

More About Transaction Advisory Services

Create sophisticated economic frameworks that aid in figuring out the real market value of a firm. Provide advisory work in connection to business evaluation to aid in negotiating and pricing frameworks. Discuss one of the most ideal kind of the deal and the kind of consideration to use (cash money, supply, gain out, and others).

Perform assimilation preparation to establish the procedure, system, and business adjustments that might be required after the bargain. Set standards for click resources integrating departments, technologies, and business processes.

Examine the potential consumer base, industry verticals, and sales cycle. The operational due diligence provides important insights into the performance of the company to be acquired worrying danger analysis and worth production.

Report this wiki page